With over 10,000 different cryptocurrencies and tokens, researching any cryptocurrency project can seem overwhelming. How do you determine which projects are worth your time? How do you know if a project is a scam or pump-and-dump scheme?

We share below 5 factors to consider when looking into any cryptocurrency project. But first, let’s differentiate between a “cryptocurrency” and a “token”.

Cryptocurrency vs. Token

A cryptocurrency is a digital asset that is integrated into a blockchain network. Cryptocurrencies can be used like cash to exchange for goods and services, but most importantly, they are used within a network to perform transactions. Ethereum, the second-largest blockchain network, has its own cryptocurrency called ether (ETH). ETH must be spent to perform transactions on the Ethereum blockchain. “Paying” to use a blockchain network for transactions is similar in concept to paying a bank or ATM fee to move money.

Tokens, on the other hand, are also cryptocurrencies. However, tokens are created on top of an existing blockchain like Ethereum. Tokens can be developed on Ethereum’s blockchain because the network allows for the creation of ERC-20 tokens. An ERC-20 token on the Ethereum blockchain represents an entirely different project. Projects don’t need to build an entire new network themselves and “piggybacks” on top of the Ethereum blockchain. To dive deeper into cryptocurrencies, learn more here.

Now with the difference between cryptocurrency and tokens out of the way, here are 5 factors to consider when doing your own research!

#1: Use Case

The first question to ask when you stumble across a cryptocurrency project for the first time is “Why does it exist?”. Projects should solve a problem. Understanding what a project does and how its cryptocurrency is used is very important.

Excellent places to start learning about a project are its website and whitepaper. A whitepaper is a highly informational document that outlines the concept of the project, how it works, roadmap, and other additional information.

Bitcoin and Ethereum, the top two most popular cryptocurrencies, have very important use cases in the crypto space.

Bitcoin and Ethereum

According to Bitcoin’s whitepaper, Bitcoin is a “peer-to-peer electronic cash system”. It is used as a medium of exchange or as a store of value. As Bitcoin evolves, another argument for holding the cryptocurrency is to hedge against inflation and the printing of traditional currencies. Bitcoin’s limited supply of 21 million coins built right into it’s code prevents any more from being “printed”, creating a digitally scarce asset.

Ethereum, the second-largest blockchain network uses its cryptocurrency “ether” (ETH) to perform transactions and run smart contracts. Smart contracts are agreements or actions written in code that execute on their own without any intermediary. Actions can include locking in a token to earn interest or creating and selling digital pieces of artwork.

The Versatility of Blockchain: More Use Case Examples

Decentralized Finance (DeFi) projects like Aave or Compound provide decentralized financial services that allow people to borrow, lend, and earn interest on cryptocurrencies. Instead of visiting a bank or registering to open a new savings account, blockchain enables the ability to save and lend, without any middleman.

Non Fungible Tokens (NFTs), like Cryptopunks, represent a digital asset such as a piece of art or a unique digital item. Cryptopunks is a collection of pixel art characters with each character connected to a unique ID (the NFT) on the Ethereum blockchain. NFTs can be traded and sold directly on the blockchain without any need for a central company or organization to facilitate the transaction.

Another type of token is stablecoins. Stablecoins represent a 1-to-1 ratio of a physical asset like the US dollar. Stablecoins (and all other cryptocurrencies) enable the ability to send money and value around the globe in seconds. Stablecoins can also be used in DeFi projects for borrowing and lending because they exist on a blockchain.

DeFi, NFTs, and stablecoins are only just the tip of the iceberg of cryptocurrency projects. Other new and exciting use cases include those for blockchain gaming, identity and privacy, supply chain tracking, decentralized exchanges, cloud storage, and more.

#2: The Team

Cryptocurrency projects are generally started by a team of developers, entrepreneurs, and/or organizations.

Cardano (ADA), for example, was started by Charles Hoskinson, the CEO of IOHK and one of the co-founders of Ethereum. The team behind Cardano also includes the Cardano Foundation and Emurgo.

When researching any cryptocurrency project, understanding the team, expertise, and academic credentials of the people and organizations on the team is vital. Projects should provide information about the founders and team members on their website. LinkedIn profiles are also a huge positive because they can show an individual’s work history and experience that can be effective in the success of a project.

#3: Partnerships

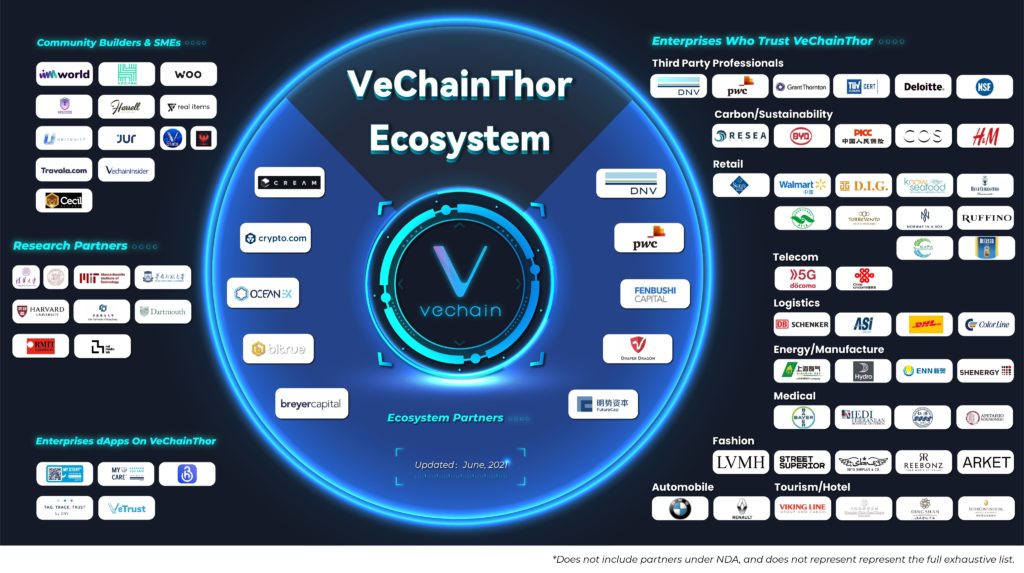

With blockchain and cryptocurrency being such a new (and risky) innovation, partnerships with well known organizations and companies can provide additional credibility to a project.

VeChain, a blockchain focused on providing real-world use cases, is known for its vast amount of partnerships, ranging from large companies like DNV, PWC, Grant Thornton, and many others.

Projects that have familiar and well-established companies as partners can provide a great indicator of where they are headed in the future. In general, the more partnerships, the better. However, in-depth research is still necessary to evaluate how each partnership is beneficial to the project.

#4: Tokenomics

Tokenomics refers to the economics of the token and how it can affect the token’s value. Information about a token’s economics can be found in the project’s whitepaper or website.

Some factors to keep in mind are token supply, token distribution, and use cases.

Token Supply

Token supply is the number of tokens available in a project. It refers to two different numbers: total supply and circulating supply.

Total supply is the number of tokens that will ever be in existence. Bitcoin, for example, can only have 21 million coins when all of them are mined.

Circulating supply is the available supply to the public. Bitcoin currently has about 18.7 million of its 21 million coins mined.

However, some projects have exceptions to token supply. Ethereum, for example, does not have a max total supply.

Token Distribution

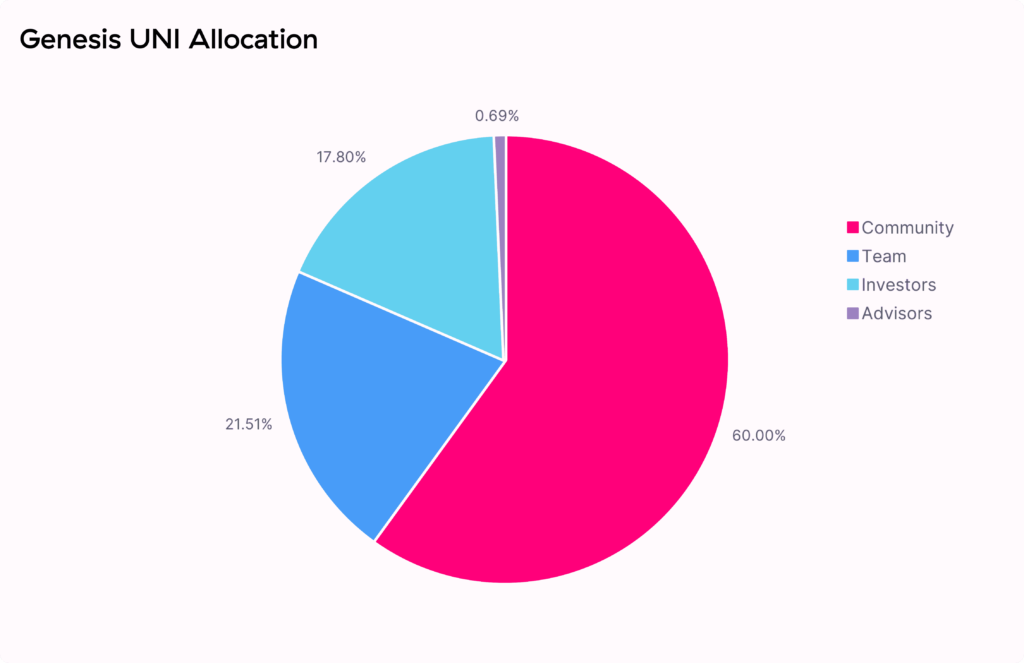

Token distribution refers to whom the tokens were allocated to at the start of a project. Many projects, especially those with pre-mined tokens (the creation of coins at the start of a project), have tokens initially distributed among the development team, the community, early investors, and advisors.

Uniswap, a platform for trading DeFi tokens, has 60% distributed to the community, with 40% held internally.

More tokens distributed to the public are preferable because it creates a more decentralized project. If tokens were mostly held internally by the team, investors, and advisors, there is a higher chance of coins being dumped into market.

#5: Social Media Presence

Social media presence can be very informative when assessing a project because it is usually the first place for news. Partnerships, achievements, and updates are usually announced by the team on their social media accounts. Following these accounts are a great resource to stay updated on any project.

However, finding great projects through social media can be tricky. Many scam coins and fraudulent projects have spent marketing dollars to pay social media influencers to pump up their follower counts and engagement. Unsuspecting newcomers fall into the hype and invest, while the creators dump their tokens shortly after. Be wary of accounts telling you to buy their tokens and share their posts without really saying what their project’s use case is.

Major social media platforms that cryptocurrency projects use include Twitter and Reddit. Many projects also have Telegram and Discord where the team engages directly with their community through direct chat.

Other Questions to Consider

There are many other factors to consider when analyzing a cryptocurrency project. In addition to our 5 factors above, other questions to consider when doing your own research include:

- Will the project be around for the next 5 years?

- What are the risks that could cause the project to fail?

- What are the project’s competitors?

Cryptocurrencies are a new, exciting, and interesting innovation. Always perform your own research and only invest with money you are willing to lose!